As the world grapples with the pressing need to transition to sustainable energy sources, the role of renewable energy projects cannot be overstated. To ensure that the projects we support at Climatize align with our mission and stand the best chance of success, we employ a rigorous vetting process.

In this blog post, we will take you through the steps we follow to evaluate and select renewable energy projects for funding.

1. Initial Screening

At Climatize, our journey begins with an initial screening process designed to assess both the project developer and the project’s alignment with our mission. During the initial screening we carry out various meetings with the project developer to evaluate their skillset, track record, experience, past projects, their vision and the team’s ability to execute. We carry out a background check of the issuer (project developer).

2. Due Diligence

Once a project passes the initial screening, it undergoes a thorough due diligence process. This stage involves a comprehensive examination of various aspects to determine the project’s feasibility and viability. Some key factors we consider include:

- Project Exploitation Plan: A well-defined plan for project exploitation is crucial for success.

- Financial Plan: We scrutinize the project’s financial plan, including capital expenditure (capex), forecasted profit and loss (P&L), balance sheet, and cash flow statement.

- Financial History: The project’s P&L for the last two years is reviewed to understand its financial stability. Projects undergo a review by a Certified Public Accountant (CPA) and in some cases an audit.

- Permits: Ensuring the project has obtained all relevant permits.

- Land Use/Ownership: We verify the project’s land use or ownership rights.

- Contracts: We examine contracts related to engineering, procurement, construction, operations, maintenance, and revenue guarantees (e.g., feed-in tariffs or power purchase agreements).

- Legal and Tax Documents: Relevant legal, tax, and subsidy documents are analyzed to ensure compliance and financial viability.

- Finance Agreements: We review finance agreements from key financiers.

- Ownership Structure: Understanding the project’s ownership structure.

- Insurance and Warranties: We assess insurance contracts and warranties. All projects must have general liability insurance.

- Commitments of Other Financiers: We assess commitments from other financiers and their due diligence efforts to gain insights into the project’s credibility.

3. Final Decision

After completing our due diligence, we make a final decision on whether to offer the project the opportunity to raise funds on Climatize. This decision is based on a holistic evaluation of all the factors mentioned above, and it reflects our commitment to supporting projects that align with our mission and demonstrate strong potential for success.

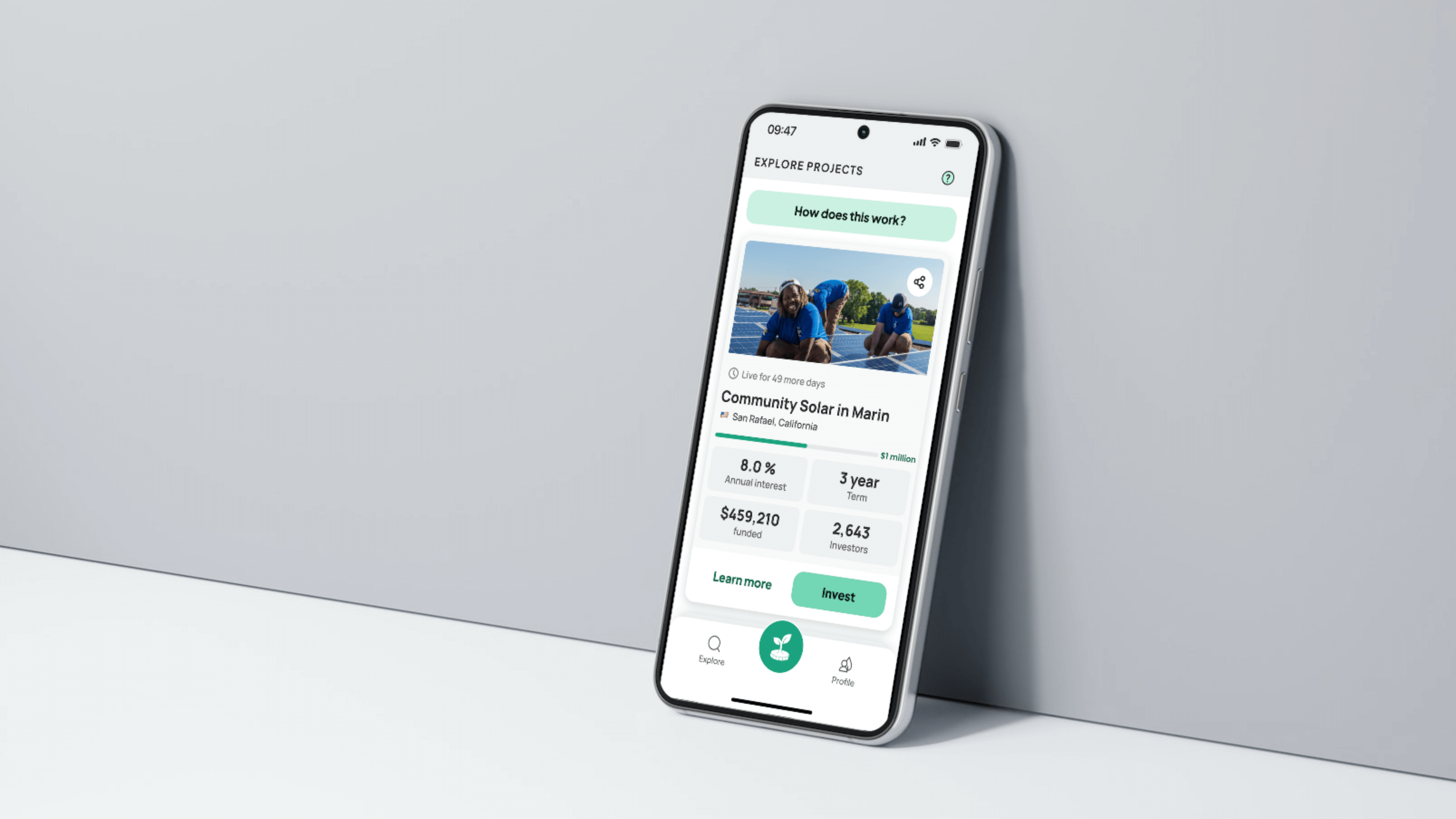

Project Goes Live

If the project moves forward, it is posted on the Climatize App. During our diligence process the issuer prepares a document called Form C (you can access the Form C in the financial section of the app) that contains the result of Climatize’s due diligence. A summary of the Form C is also available. It is important you make your own research before making an investment.

Conclusion

Climatize’s thorough vetting process ensures that the renewable energy projects we support are not only environmentally responsible but also financially viable and capable of making a positive impact. We believe that this meticulous approach to project evaluation is essential in driving the global transition to sustainable energy sources. By selecting and supporting the right projects, we contribute to a brighter, cleaner, and more sustainable future for all.

Financial Disclosure

Prior results do not guarantee future success. It’s important to note that investing in renewable energy projects through crowdfunding carries financial risks and may not be suitable for everyone. As with any investment, there is a possibility that you may lose some or all of the money you invest. It’s important to note that this article should not be considered investment advice. The information provided is for informational purposes only and is not intended to be a recommendation or endorsement of any particular investment strategy. The information provided in this article is for informational purposes only and should not be considered financial or investment advice. It’s crucial to do your own research and consult with a financial advisor or professional before making any investment decisions, especially when it comes to investing in renewable energy projects through crowdfunding, which carries financial risks and may not be suitable for everyone.

Copyright@ Climatize Earth Inc 2023.

Copyright@ Climatize Earth Inc 2023.